January is more than just a page on the calendar; it is the financial reset every Filipino professional needs. While most resolutions fade by February, the decision to shift from being a “spender” to an “owner” is one that pays dividends for decades.

As we step into 2026, we ask why real estate investment is ideal. The Philippine economy is showing remarkable resilience, with the property market serving as a top-tier hedge against inflation and market volatility (Bangko Sentral ng Pilipinas, 2025).

1. Why Real Estate Investment in the Philippines Beats Depreciating Assets

The first rule of 2026 financial planning is simple: Buy what grows. Unlike a new car or the latest gadget—which lose value the moment they are used—real estate investment in the Philippines in high-growth areas historically appreciates (Colliers Philippines, 2025).

According to 2026 market outlooks, properties near major infrastructure projects are seeing a significant surge in value. Positioning yourself in the path of growth is key:

* Milan Residenze Fairview — Perfectly situated near the upcoming MRT-7 and major commercial hubs in Quezon City (Euro Towers International, n.d.).

2. Condominium Development Promotions in the Philippines

January is often the best time to negotiate. Many developers offer “New Year Kickoff” promos or flexible payment terms that aren’t available during the peak mid-year season.

Financial Tip: Look for Ready-for-Occupancy (RFO) units if you want to generate rental income immediately.

The Euro Towers Advantage: Projects like Vivaldi Residences Cubao offer prime RFO opportunities in the heart of a transit-oriented district.

3. Create a Passive Income Stream through Condominiums

A smart financial decision isn’t just about saving; it’s about making your money work for you. A condo unit in a high-demand area serves as a self-liquidating asset.

With the return of full-time office work and university classes in 2026, the demand for urban dwelling is at an all-time high (Leechiu Property Consultants, 2025). By choosing a unit in Vivaldi Residences Davao, you tap into the booming Mindanao economy, catering to both local professionals and tourists.

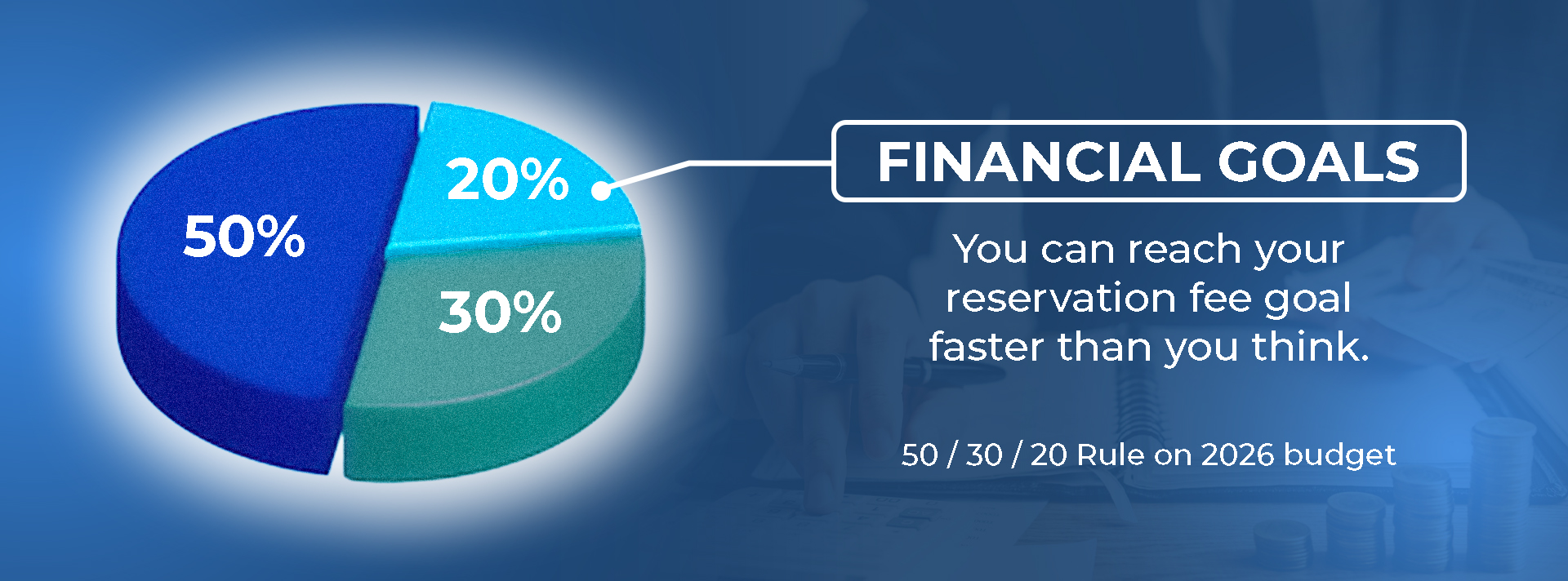

4. The 50/30/20 Rule for Home Ownership

If your goal is to own a home this year, apply the 50/30/20 rule to your 2026 budget (Warren & Tyagi, 2005):

* 50% for Needs: Rent, Food, Utilities.

* 30% for Wants: Entertainment and lifestyle.

* 20% for Financial Goals: Your Euro Towers Down Payment.

By automating this 20% into a dedicated “Property Fund,” you can reach your reservation fee goal faster than you think.

Crunch the Numbers: Plan Your Investment

The most successful investors don’t guess, they calculate. To help you visualize your path to homeownership, we’ve provided a tool to help you estimate your monthly payments and interest.

Start your 2026 budget planning here: Euro Towers Loan Calculator

Using this tool, you can input your target property price and see how different down payment options and loan tenures fit into your monthly income.

Your 2026 Financial Checklist:

- Audit your Debt: Clear high-interest credit card debt to improve your credit score for a home loan.

- Research the Market: Focus on Transit-Oriented Developments (TODs) as they hold the highest resale value (Colliers Philippines, 2025).

- Schedule a Viewing: Experience the quality of Euro Towers firsthand rather than just looking at flyers.

Expert Insight: “Financial freedom isn’t about how much you earn, but how much of that earning you turn into equity.” — Philippine Investment Guide (2026)

Ready to make your move?

Visit the Euro Towers International Official Website today to view our latest inventory and flexible 2026 payment plans.

References

Bangko Sentral ng Pilipinas. (2025). Monetary policy report: December 2025. https://www.bsp.gov.ph/Price%20Stability/MonetaryPolicyReport/FullReport_December2025.pdf

Colliers Philippines. (2025). 2026 Philippine real estate forecast: The impact of infrastructure on property valuation. https://www.colliers.com/en-ph/research/colliers-quarterly-property-market-report-philippines-q3-2025

Euro Towers International. (n.d.). Our projects: Milan Residenze Fairview, Vivaldi Residences Cubao, & Vivaldi Residences Davao. Retrieved January 20, 2026, from https://eurotowersintl.com/

Leechiu Property Consultants. (2025). The state of Philippine real estate: Rental yield and occupancy trends. https://leechiu.com/market-insights

Philippine Investment Guide 2026. (2026). Strategic wealth management in the emerging Asian market. Investor Press.

Warren, E., & Tyagi, A. W. (2005). All your worth: The ultimate lifetime money plan. Free Press.