The “rent or buy” debate is a rite of passage for many Filipinos. But in 2026, the answer is becoming clearer. With the Philippine economy stabilizing and the real estate market entering a phase of “resilient growth,” the window to transition from tenant to owner is wide open (Manila Standard, 2025).

While renting offers short-term flexibility, buying a condo—especially in high-growth zones like Quezon City and Davao—is increasingly becoming the superior strategy for long-term wealth.

Here is why swapping your monthly rent for a mortgage makes financial sense this year:

1. Escaping the “Dead Money” Trap

The most compelling argument against renting remains unchanged: your monthly payment vanishes. When you rent a condo, you are essentially funding your landlord’s investment.

In contrast, buying transforms that monthly expense into equity. With every payment, you own a larger slice of the property. Over time, this asset becomes part of your net worth—a safety net you can sell, lease, or pass down.

* Read More: How to Build Wealth with Real Estate

2. Capital Appreciation: The Infrastructure Effect

While rental rates in Metro Manila are projected to remain relatively flat this year, property values are rising, driven by massive government spending (BusinessWorld, 2025); and when new roads and trains are built, property prices in the area usually go up.

* Quezon City & Fairview: The local government has approved a record ₱43.3 billion budget for 2026 to upgrade infrastructure and social services (Quezon City Government, 2026). With the MRT-7 and Metro Manila Subway nearing full operation, properties in Fairview are set to spike in value. Buying now locks in today’s price before these projects are fully realized.

* Davao City: As the “King City of the South,” Davao is booming. The Regional Development Council XI has endorsed a ₱335 billion budget for 2026 infrastructure, including the ongoing Davao City Bypass Road (NEDA Region XI, 2026). This growth ensures that real estate here is not just a home, but a growing asset.

3. The RFO Advantage: Move-In Speed of Renting, Security of Owning

A major reason people rent is the need for immediate housing. They cannot afford to wait years for a pre-selling unit.

RFO units (Ready-For-Occupancy) solve this problem.

* Immediate Use: You can move in as fast as you would with a rental.

* Tangible Value: You inspect the actual unit—checking the cuts, the view, and the finishes—before you pay.

* Stable Payments: Unlike rent, which landlords can increase annually, your amortization (especially with Pag-IBIG) is generally fixed.

Explore Availability: Browse Our RFO Units

4. It Is Easier Than You Think (Pag-IBIG & Card Options)

A common myth is that buying requires a mountain of cash, but that’s no longer the case. At Euro Towers, we have simplified the entry barriers with flexible Payment Options.

* Pag-IBIG Financing: We offer a structure where you pay a 20% downpayment over up to 36 months, with the 80% balance covered by a Pag-IBIG loan. This keeps your monthly cash outlays manageable.

* Card Payments: We accept credit card and debit card payments for reservation fees and monthly equity. This adds convenience and allows you to earn bank rewards on your housing payments.

Know more about these payment options in our previous article about Pag-IBIG and credit cards payments: Euro Towers Now Accepts Pag-IBIG and Card Payments for RFO Units (2026)

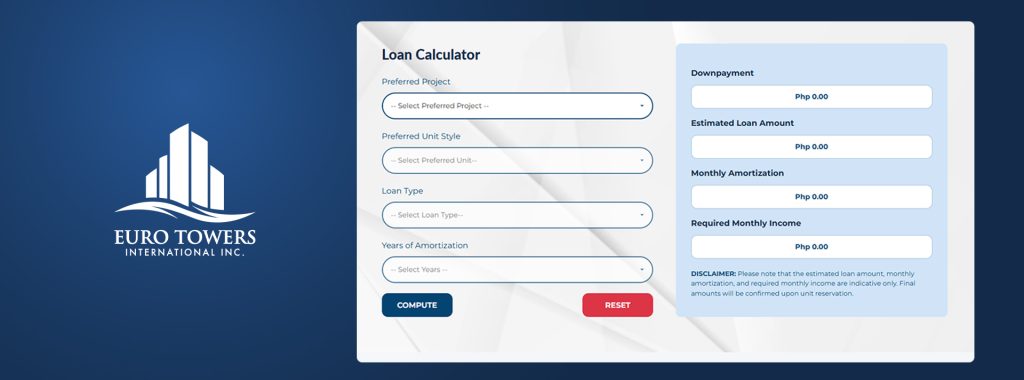

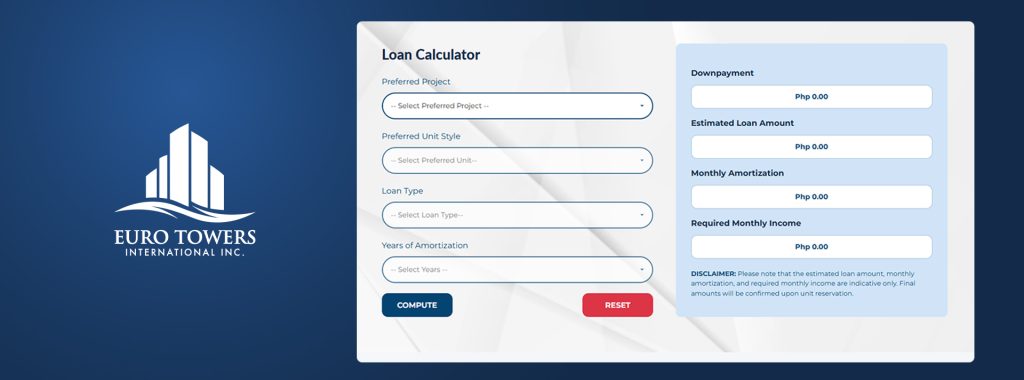

5. Run the Numbers: Use Our Loan Calculator

Are you unsure if your current rent budget matches a monthly amortization? You don’t need to guess.

We have integrated a Loan Calculator directly into our website. Simply input the price of your desired unit in Quezon City or Davao to see a clear estimate of your monthly payments. You will often find that for a little more than your current rent, you could be paying for your own home.

Renting may offer temporary freedom, but buying offers permanent security. In a growing economy like the Philippines, owning a piece of real estate is one of the few ways to ensure your hard-earned money works for you.

Stop paying your landlord’s mortgage.

Go to our Site Visit Scheduler today to see how close you are to owning your own RFO unit.

You can also chat with our representative using the website chat feature, so you can get immediate answers to your inquiries.

References

BusinessWorld. (2025, December 30). Metro Manila rental yields may stay flat in 2026 — analysts. https://www.bworldonline.com/property/2025/12/30/721458/metro-manila-rental-yields-may-stay-flat-in-2026-analysts/

Euro Towers International Inc. (n.d.). Euro Towers Now Accepts Pag-IBIG and Card Payments for RFO Units. Retrieved January 26, 2026, from https://eurotowersintl.com/blogs/euro-towers-now-accepts-pag-ibig-and-card-payments-for-rfo-units-2026/

Manila Standard. (2025, December 14). Colliers sees resilient real estate growth in 2026. https://manilastandard.net/real-estate/314680474/colliers-sees-resilient-real-estate-growth-in-2026.html

NEDA Region XI. (2026, March). RDC XI endorses fiscal year 2026 budget proposals of Davao Region government agencies. National Economic and Development Authority. https://rdc11.neda.gov.ph/rdc-xi-endorses-fiscal-year-2026-budget-proposals-of-davao-region-government-agencies/

Quezon City Government. (2026, January 21). QC Council approves P43.3-B budget for 2026. https://quezoncity.gov.ph/qc-council-approves-p43-3-b-budget-for-2026/